Yesterday, the Federal Trade Commission (“FTC”) published revised thresholds for the Hart-Scott-Rodino (“HSR”) Act, which will take effect on February 23, 2022. Earlier, the FTC also announced new thresholds for Section 8 of the Clayton Act, which governs interlocking directorates. Each of these thresholds is higher for 2022, than for 2021. The HSR Act and Section 8 thresholds are adjusted annually based on the change in gross national product. The maximum daily civil penalty for violations of the HSR Act, which is tied to inflation, has also increased.

HSR Act Thresholds

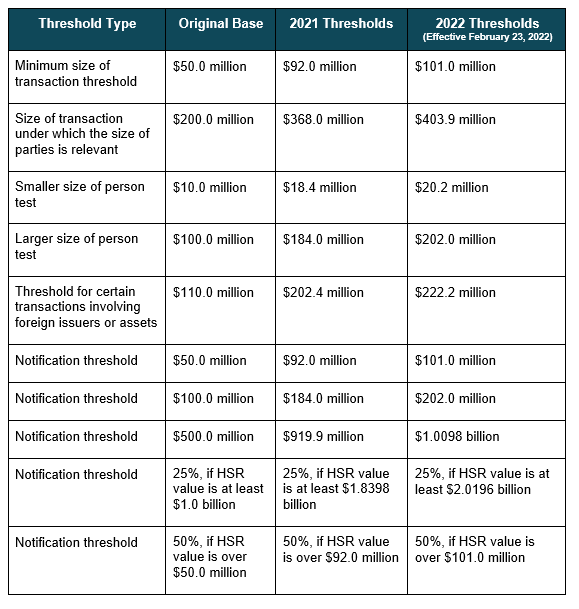

The HSR Act requires parties to certain mergers and acquisitions to notify the FTC and Antitrust division of the U.S. Department of Justice (“DOJ”) and observe a waiting period (usually 30 days) prior to consummating a reportable transaction. The jurisdictional thresholds are adjusted annually. Beginning February 23, 2022, acquisitions resulting in aggregate holdings of voting securities, assets, or controlling interests in non-corporate entities valued at more than $101 million may be reportable (“size of transaction”).

For transactions that result in aggregate holdings valued at more than $101 million, but less than $403.9 million, the parties will also need to meet the “size of person” test for the Act to apply. This test will require one “person” to have annual net sales or total assets of at least $202 million and the other “person” to have at least $20.2 million in annual net sales or total assets. However, if the “acquired person” is not “engaged in manufacturing,” the smaller size of person test will only be met if it has assets valued at more than $20.2 million.

The notification thresholds, which are used to determine whether a new filing is required for the acquisition of additional voting securities within five years of the expiration or early termination of a prior filing, will also increase, as shown below.

The HSR filing fees will not be adjusted; however, the valuation thresholds that are used to determine the filing fee that applies to a specific acquisition will each be increased. Legislation to change the HSR filing fees has been proposed but, as of this writing, has not yet been passed.

With certain exceptions, Section 8 of the Clayton Act prohibits one person from serving as a director or officer of two competing corporations at the same time, if each competitor corporation has capital, surplus and undivided profits above an annually adjusted threshold. Effective January 24, 2022, this threshold is $41,034,000.Section 8 Thresholds (“Interlocking Directorates”)

However, this prohibition does not apply if:

- the “competitive sales” (as defined by the statute) of either corporation are less than 2 per centum of that corporation’s total sales;

- the “competitive sales” of each corporation are less than 4 per centum of that corporation’s total sales; or

- the “competitive sales” of either corporation are less than an annually adjusted threshold. Effective January 24, 2022, this threshold is $4,103,400.

Civil Penalties

Finally, the FTC has announced the maximum daily civil penalty amount for HSR violations. The amount increased from $43,792 to $46,517 per day of the violation. The new maximum applies to civil penalties assessed on or after January 10, 2022, regardless of when the underlying violation occurred.